Gross Income Multiplier Is Used for Which Property

The most commonly used approaches to determine the current market value of a property are the cost approach income approach sales comparison approach and gross rent multiplier. Gross income Income net of taxes paid.

Gross Rent Multiplier A Beginner S Guide Propertymetrics

A GRM of six times a gross rental income of 40000 gets you get a fair market estimate of 240000.

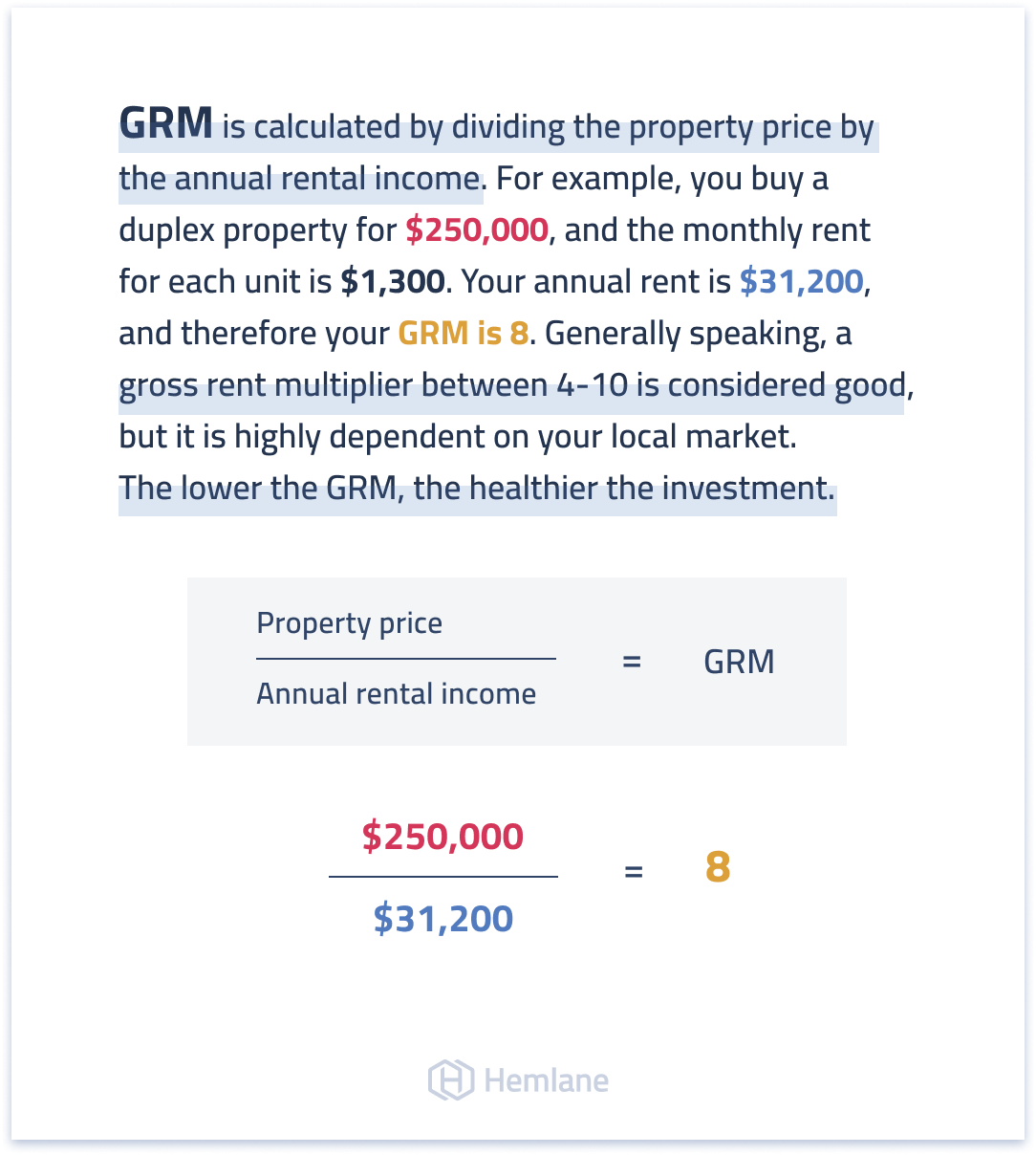

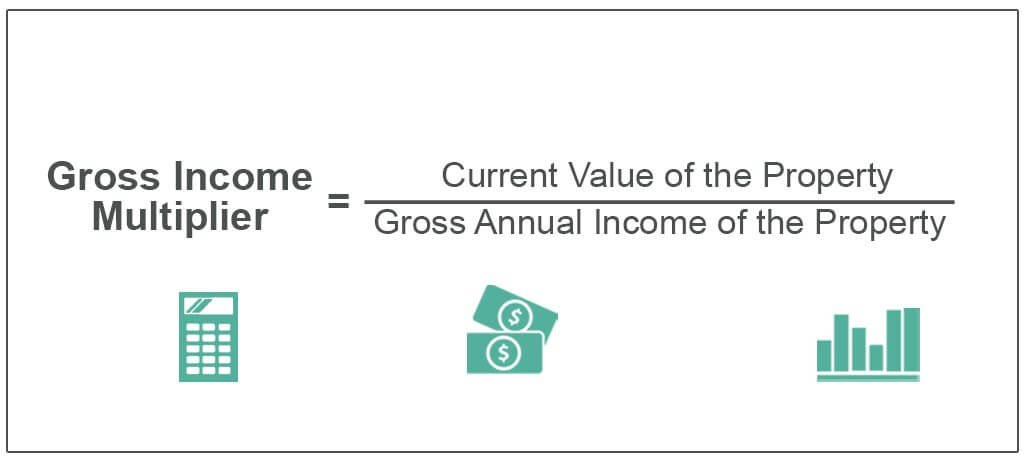

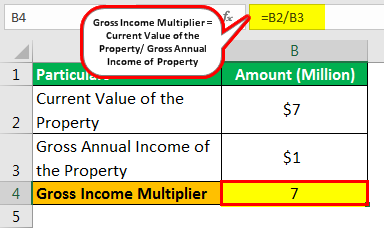

. Gross rent multiplier GRM is a figure used to evaluate multi-unit and commercial income producing real estate investments. The lower the GRM is the more potential a commercial property may have everything else being equal. The gross income multiplier is obtained by dividing the propertys sale price by its gross annual rental income and is used in valuing commercial real.

While it sounds a little tricky it really is quite easy as long as. Maybe you know the GRM for the properties in the area is six and you used a gross rent estimate if the property is vacant of 40000. Gross Rent Multiplier is a quick and easy calculation for determining if a property deserves further evaluationGross Rent Multiplier GRM Sale Price Potential Annual Gross IncomeIn general the lower the number the better.

Gross Rent Multiplier Property Price Gross Rental Income So for example if a property is selling for 2000000 and it produces a Gross Rental Income of 320000 the GRM would be. The gross income multiplier is obtained by dividing the propertys sale price by its gross annual rental income and is used in valuing commercial real. To calculate GRM simply divide the property purchase price by the gross annual rent.

Often used for residential rentals and commercial property investments the income approach focuses on the projected annual income divided by its current value. But its also impor. Hedge finance Financing used by firms to fulfil contractual payment obligations using cashflow.

It uses the price of the building divided by the gross rents to arrive at a ratio that may be compared and contrasted with. If a property generates 300000 in gross rental income each year and is priced at 45 million the GRM would be 15 45 million 300000. 3500 monthly rent x 12 months 42000 gross rental income After you have determined the gross annual income determining the gross rent multiplier is a matter of dividing the rental property value by the number that was just found.

40000 x 6 240000. The comparable sales provide the appropriate market multiplier to use with the subject property. While all of these approaches are widely accepted and based on data a propertys true value is whatever price the buyer and seller agree upon.

The income measure can be Potential Gross Income Effective Gross Income or Net Operating Income. 450000 property value 42000 gross rental income 107 GRM. Direct capitalization requires that there is good recent sales data from comparable properties.

The Gross Rent Multiplier GRM is a capitalization method used for calculating the approximate value of an income producing commercial property based on the propertys gross rental income. If a rental cottage costs 120000 to buy and the projected monthly income from the rental is 1200 the capitalization rate is 12 percent 12 x 1200120000. Gross unemployment benefit replacement rate The proportion of a workers previous gross pre-tax wage that is received gross of taxation when unemployed.

If the house will sell for 175000 the gross income multiplier is 175. This is likely to be a stronger investment than a house with 2000 in. Gross Rent Multiplier Property Price Gross Annual Rental Income.

Gross Rent Multiplier A Beginner S Guide Propertymetrics

Gross Rent Multiplier Formula Example Rethority

Create Build Wealth With Real Estate Investing Biggerpockets Real Estate Investing Being A Landlord Real Estate Investor

Personal Loan Eligibility Personal Loans Lenders Person

Kitchen Design 101 What Is An L Shaped Kitchen Design Dura Supreme Cabinetry L Shaped Kitchen Kitchen Designs Layout L Shape Kitchen Design

Early Retirement Financial Independence Fi Spreadsheet Budgets Are Sexy Early Retirement Budget Template Free Spreadsheet

Gross Rent Multiplier Income Producing Real Estate Broker Rent

Gross Rent Multiplier A Beginner S Guide Propertymetrics

Gross Rent Multiplier Formula Example Rethority

A Beginner S Guide To The Gross Rent Multiplier

Gross Income Multiplier How To Calculate Gross Income Multiplier

Security Deposit Agreement0001 Real Estate Forms Rental Agreement Templates Agreement

Investment Property Analysis Gross Rent Multiplier Cap Rate Cash On Cash Return Melody Montero Real Estate Real Estate Investment Property Outdoor Decor

How I Spot Bad Investing Advice Ngfi In 2020 Investing Advice Vulnerability

Have You Heard Of The 5 25 Rule Tag A Friend That Knows Warren Buffett Fol Online Business Marketing Small Business Success Business Ideas Entrepreneur

Gross Income Multiplier How To Calculate Gross Income Multiplier

A Beginner S Guide To The Gross Rent Multiplier

How Beneficial Is The Gross Income Multiplier Income Real Estate Tips Financial Independence